[ad_1]

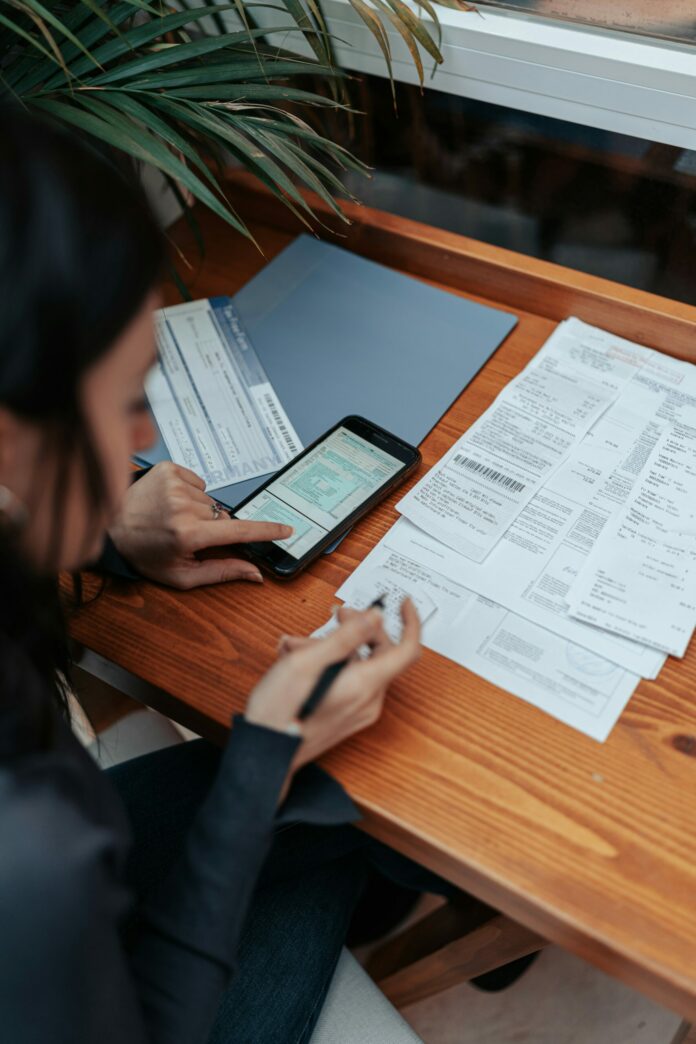

Dealing with a tax levy on paycheck can be daunting. Suddenly, your earnings shrink, and financial planning becomes a challenge.

This guide aims to help. We’ll explore effective strategies to buffer the impact of bank levy laws by state on a paycheck.

Discover how smart budgeting and financial adjustments can replenish your funds. Learn to navigate the complexities of tax levies without sacrificing your financial health. With the right tips and tricks, you can maximize your earnings and regain stability.

Understand Your Tax Levy

To handle a tax levy, start by really getting to know what it’s all about. A tax levy is when the IRS or other tax folks can take part of your paycheck to pay off your tax debt.

It’s important to know which kind of levy you’re facing, why it’s happening, and how long it’ll last. This info helps you understand your situation better so you can plan your finances more wisely.

Knowing the details can help you figure out how to deal with the levy more smartly, maybe even find ways to fight it or handle it better. Talking to a tax pro can also be a big help. They can look into your specific case and give you advice just for you.

Communicate with Your Employer

When you have a tax levy, talking to your boss is important. You need to let them know what’s happening quickly so they can understand and help you.

Your boss has to follow the tax levy rules, but they can also give you advice. Ask them to explain how the levy will change your pay.

See if there are any benefits or programs at work that can help you with money problems. Being open about your situation can make your boss trust you more, and they might let you work differently or give you your salary early.

Remember, your boss isn’t against you. They can help you. By working together, you can find ways to lessen the tax levy’s impact on your money situation.

Assess and Adjust Your Budget

Facing a tax levy means it’s crucial to look closely at your budget. Here’s how to start: First, check how you’re spending money to find ways to save.

Cut down on things you don’t need, like eating out, and make sure you cover your basic needs first. It might also help to combine any debts you have to pay less interest.

Making a plan to use your money wisely is key, especially when you have less income. Try to put a little money aside for emergencies if you can. This emergency fund is like a safety net for surprise costs. By being careful with your budget, you can handle a tax levy without too much stress.

Leverage Debt Repayment Strategies

When dealing with a tax levy, it’s smart to have a plan for paying off your debts. Think about paying the ones with the highest interest rates first-this is called the avalanche method, and it helps you save on interest costs.

If you like quick wins, try the snowball method where you pay off the smallest debts first. It feels great to cross debts off your list, motivating you to keep going. You can also think about combining your debts into one with a lower interest rate, making it easier to manage.

Talk to the people you owe money to; they might let you pay in a way that’s easier for you. Setting up auto-pay can also save you from late fees. By using these tips, you can better handle your money, deal with the tax levy, and get back on stable financial ground.

Seek Professional Advice

When you’re facing tough tax problems, like a tax levy, it’s really helpful to talk to experts. Income tax services or pros who know a lot about taxes can help you out.

They can deal with the IRS for you and help set up a payment plan that fits your situation better. They can also tell you about tax breaks or credits you might not know about, which could help you get more money back on your tax return. This can help soften the hit of the levy.

Increase Your Tax Withholding

If you want to avoid tax trouble later on, think about having more tax taken out of your paycheck now. It’s like telling your job to send more money to the IRS for you. This way, you won’t owe a lot of money when it’s time to do your taxes, and it might even help you avoid tax problems in the future.

You can talk to your HR department about changing your W-4 form to make this happen. Yes, you’ll get a bit less in your paycheck, but it could mean getting a bigger tax refund later. Plus, it’s a smart way to make sure you’re all good with your taxes.

Just make sure you can still cover your bills with a smaller paycheck. It takes some planning, but it’s a smart move to avoid owing money on your taxes and the stress that comes with it.

Utilize Pre-Tax Benefits

Using pre-tax benefits is a smart way to handle your money when dealing with taxes. These benefits, often offered by your employer, let you use some of your earnings for specific expenses before taxes are taken out. This means you can lower the amount of money the government says you owe in taxes.

Some examples are health savings accounts (HSAs), flexible spending accounts (FSAs), and retirement plans like 401(k)s. When you put money into these accounts, you pay less in taxes and also save for things you’ll need later on, like healthcare or retirement.

By doing this, you can reduce your tax bill and maybe even lower the impact of a tax levy (when the government takes some of your income to cover taxes you owe). Plus, these accounts can help cover healthcare and retirement costs, which might be harder to afford because of the tax levy.

To benefit from these pre-tax options, you need to plan carefully and make sure they fit with your overall financial goals and any tax issues you might have. Talking to a tax expert can help you make the most of these benefits and deal with any tax challenges.

Explore Tax Credits

Looking into tax credits can help lower what you owe in taxes. Think of tax credits like coupons that take money directly off your tax bill. This is different from deductions, which just reduce the amount of income the government can tax.

Make sure to check out tax credits you might get, like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). These can cut down your taxes a lot, making things easier if you’re facing a tax levy.

If you or your kids are in school, look into education credits. Also, if you make your home more energy-efficient, you might get credits for that too. This way, you improve your home and save on taxes at the same time.

Keep an eye out for any tax credits you could use. Talking to a tax professional can also help make sure you’re saving as much as possible on taxes, which is a smart move to protect your money.

Explore Settlement Options

If you’re struggling with a tax levy, talking to the IRS or state tax office about settling your debt can help. One way is an Offer in Compromise (OIC), where you might pay less than what you owe.

You’ll need to show them your finances to prove you can’t pay the full amount. Another way is an installment agreement, letting you make smaller payments over time.

Sometimes, if you’re struggling, the IRS might stop collection actions temporarily (this is called “currently not collectible” status). It’s really important to get advice from a tax professional to figure out the best option for you.

Getting a settlement can stop the levy and help you move towards a more stable financial situation. Just make sure you choose a plan that you can afford, to avoid future tax problems.

Side Hustles and Freelancing

Looking into side hustles and freelancing might help ease the financial pinch of taxes. These options are great because they’re flexible; you can fit them around your main job to make extra cash. You could do anything from tutoring online, writing, and driving for a rideshare company, to selling stuff you’ve made.

Freelancing is especially cool if you’ve got a knack for something specific like graphic design, digital marketing, or coding. You’ll need to think about how much time you can spend and maybe put some money in at the start.

Prioritize Financial Planning

Financial planning is super important, especially when you have to deal with something like a tax levy garnishment. It’s all about knowing where you stand financially, setting goals, and figuring out how to reach them.

Think of it like planning a trip. You need to know where you’re starting from, where you want to go, and how you’ll get there. Every step, whether it’s making a budget or saving for the future, is a piece of the puzzle to help you reach your destination.

It’s also key to keep an eye on your plan and tweak it as things in your life change. This way, you stay on the right path. Plus, getting advice from financial experts can help you make smart choices. By focusing on your financial planning, you can use your money wisely, cut down on debts, and feel more secure about your finances.

Utilize Government Assistance Programs

If you’re hit with a tax levy and feeling the money pinch, don’t forget about government help programs. These are set up to help you out with things like food, a place to live, and keeping you healthy.

Getting into these programs can lessen the money stress a bit. It’s important to dig around and apply for the ones you can use. A lot of folks miss out because they don’t know about these benefits, but they can help when times get tough. Each state has different programs based on what you need, so make sure to look carefully.

You might also want to talk to a social worker or a financial advisor who knows the ins and outs of government help. Using these programs can give you some space to sort out your money and tackle those tax issues.

Stay Compliant

When dealing with a tax levy, it’s really important to do everything the tax authorities ask. This means sending any documents they want on time and keeping track of all your interactions and payments with them.

You should also regularly check your tax status online to know what’s happening with your account. If you don’t follow their rules, you might have to pay more money or face other consequences.

Work closely with the IRS or your local tax office to show you’re serious about fixing the issue. Getting help from a professional can make sure you’re doing everything right and might even solve the problem faster.

Stay Informed

Staying informed is critical when dealing with a tax levy on your paycheck. It’s vital to keep abreast of any changes in tax laws that could affect your situation.

Regularly consulting reliable financial news sources and the IRS website can provide updates on relevant tax legislation and policies. Understanding these updates can identify new opportunities to manage or mitigate the impact of a tax levy.

Participating in forums or online communities focused on tax issues can also offer insights and practical advice from others who have faced similar challenges. Engage with these platforms to exchange strategies and learn from shared experiences.

Additionally, utilizing educational resources provided by financial institutions or government agencies can further deepen your knowledge and equip you with the tools needed for effective financial management. Always seek out accurate and up-to-date information to make well-informed decisions regarding your tax situation.

Navigating Beyond the Tax Levy on Paycheck

It takes smart decisions and planning to get around a tax levy on paycheck. If you know your options and use smart strategies, you can lessen the financial effects of a tax levy.

A paycheck tax levy can be avoided by following the rules, learning about the tax, and getting professional help. Plan your finances carefully and use help programs to get back on track.

Keep in mind that getting better takes time and work. Keeping track of a paycheck tax levy is important for financial security.

Did you like this guide? Great! Please browse our website for more!

[ad_2]

gentwenty.com